For anyone new to the web3 space or with limited experience, the word “mining” may come up frequently. It is a very important part of the web3 ecosystem. First off, what is mining? Mining is simply validating transactions that are carried out on the blockchain. It can also be a term for the work that members of the network do in order to exchange and earn new tokens.

Who are the miners?

Miners are people that audit the transactions that are performed on the blockchain, and they verify the legitimacy of cryptocurrency transfers. The idea of mining stemmed from the founder of Bitcoin, Satoshi Nakamoto, who brought forward the idea of curbing the problem of double spending. Double spending is a situation in which the same units of a blockchain are spent twice.

Miners’ functions

Mining is done either individually or by an organization with access to proper hardware and software resources. The growth of mining in recent years and the cost of being fully involved in the process means it is increasingly difficult for newcomers to make headway for themselves.

Mining Methods

There are various methods by which mining is done, which vary in the amount of time required for running and cost. As Bitcoin was making its breakthrough as the premium cryptocurrency, CPU mining was popular among most of the miners.

However, with the improvement of technology, using a CPU for mining has been slow and impractical because of the time it takes to even gain any semblance of profit owing to the high electrical and cooling costs of the hardware.

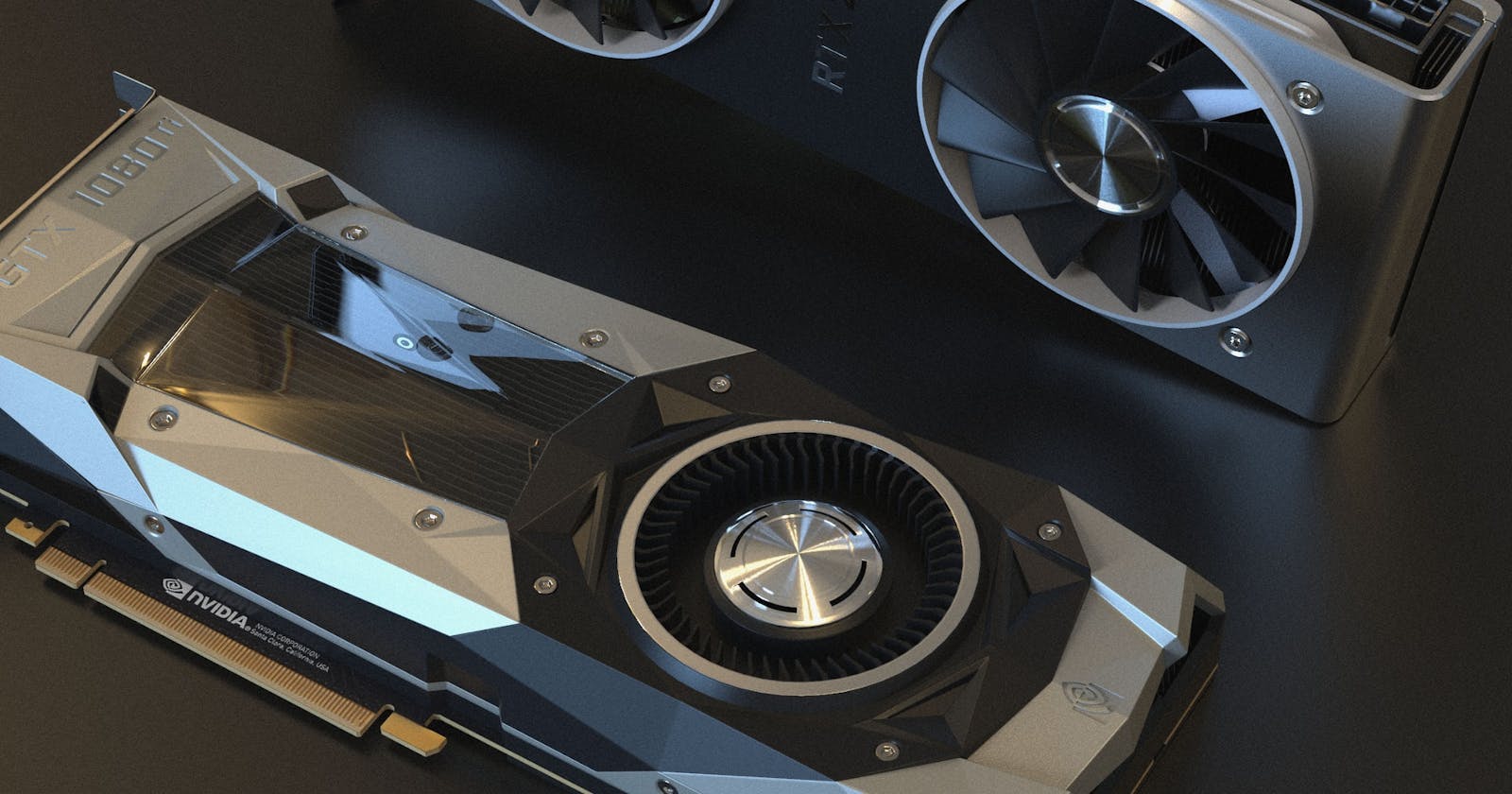

Another piece of hardware that is used in mining cryptocurrencies is the Graphics Processing Unit, or GPU.

A GPU works to effectively use computational power by mashing together a set of GPUs in one mining rig. GPU mining requires that there be a motherboard and a cooling system. Application Specific Internet Circuit, or ASIC, mining is another means of mining cryptocurrency.

Unlike GPU miners, ASIC miners are custom-built to mine cryptocurrencies, which means there is a more direct pathway to cryptocurrencies unlike GPUs, which are just general computer hardware. Classically, these are more expensive to purchase and maintain, and as time goes on, they become obsolete quickly.

An unorthodox method of mining compared to the other aforementioned methods is cloud mining. Cloud mining is different because it works based on the power of major corporations and other facilities specially created and dedicated to crypto mining.

There are options for individual miners to use both free and paid cloud mining hosts and sort of rent these rigs for the time stipulated.

The importance of miners

We cannot underestimate the role of miners as they add a lot of value to the ecosystem, and without them, it would simply collapse. Some important things they bring include:

- Validating and Confirming Transactions

The number of transactions that occur daily in cryptocurrency is huge. When a transaction occurs, a block is created on the blockchain. A transaction could be fraudulent and, without a central body to decipher what it is, authentication measures had to be put in place and that is what miners handle. They validate each block that appears on the blockchain as a service. After confirming whether or not a transaction is authentic, it is then included in the blockchain.

- Network Security

Transactions and data flow in a trustless manner, meaning there is no intermediary or corporation like a bank that serves as a central hub or overseeing power. That effectively means that miners, being the ones who validate transactions, serve as the security personnel. The more miners there are, the better the network security will be. Competition among the miners is great for the ecosystem. The difficulty associated with solving for the right hash and the financial reward work together to create a secure consensus mechanism that makes it highly cost-ineffective for any malicious users to make headway.

The advantages and disadvantages of being a miner

Mining has its purposes. Apart from enriching miners, there is another fundamental purpose that mining serves, which is the fact that it is the only way to release new cryptocurrency into circulation. As of March 2022, it was revealed that the number of bitcoins now in circulation had reached 19 million out of a total of 21 million. If there were no miners, coins would still be usable but there would be no new ones in circulation, and that is an important role that miners play.

There are other advantages to being a miner. You can get “voting” power for when changes are needed to be made in the Bitcoin network. This is commonly referred to as the Bitcoin Improvement Protocol (BIP). Miners have an influence over the decision-making process for matters. The greater hash power that a person has, the more votes they are able to cast at such times.

There are several negative factors associated with mining.

The first and most important one is financial. Miners could go through a lot of effort, purchasing hardware that could cost as much as hundreds of thousands of dollars and have next to zero return on their investments because of the sheer number of competitors that they have to work against and who are constantly searching for means to improve the efficiency of their mining processes. Energy consumption as a factor has to be considered. Continually running equipment, which is the case in the growth of Bitcoin mining, comes with concerns about the effect on the environment and the carbon footprint left behind in the search for more cryptocurrencies.

In that case, it is also important to note that there could be potential legal factors at play. The majority of authorities have no laws that govern mining practices. Hence, for most countries, mining cryptocurrency is not an illegal venture. In some countries, such as Israel, crypto mining is considered a business and, hence, tax is required on any earnings. There are very few countries that prohibit mining.

A guide for checking the laws regarding cryptocurrency for various countries can be found here. The laws are fluid and almost always change, so miners have to pay a lot of attention to laws being passed that could affect their bottom line at the end of the process.

The Mining Process

Mining is slightly tweaked for different coins, but for Bitcoin, it engages in the proof of work consensus system. That simply means that to earn new bitcoin, a miner has to be the first to get the right answer or the closest possible answer to a numerical problem. This proof of work activity has to be done to find the answer to the puzzle.

Miners are constantly trying to come up with a 64-digit number (hash) that is less than or equal to the target hash. It is basically guesswork. This is an extremely random process, but since the number of guesses for each problem could be in the range of trillions, that is where it becomes such a laborious task that requires high computation power.

Also, the number of solutions increases with each miner that joins the mining network. A person might think there are a lot of complex calculations going on behind the scenes, which is true, but it is not because of the math involved. It stems from the number of solutions and the constant work to provide the correct one. The rate of bitcoin “mined” is gradually reduced over time, and calculations show that the final bitcoin will not come into circulation until the year 2140. Transactions will not end in 2140 as miners will still need to verify transactions and fees are given to them to maintain the integrity and security of the network.

Conclusion

You can now understand who miners are, what they do, their importance to the ecosystem, and how it wouldn’t function properly without them. You could get more coins by being a miner, but your chances of doing that individually are quite low. It is more advisable to join a pool of fellow miners and get a cut of the earnings.